Smart Info About How To Start A Loan Company

You will need to provide financial statements for your business in order to get an sba loan.

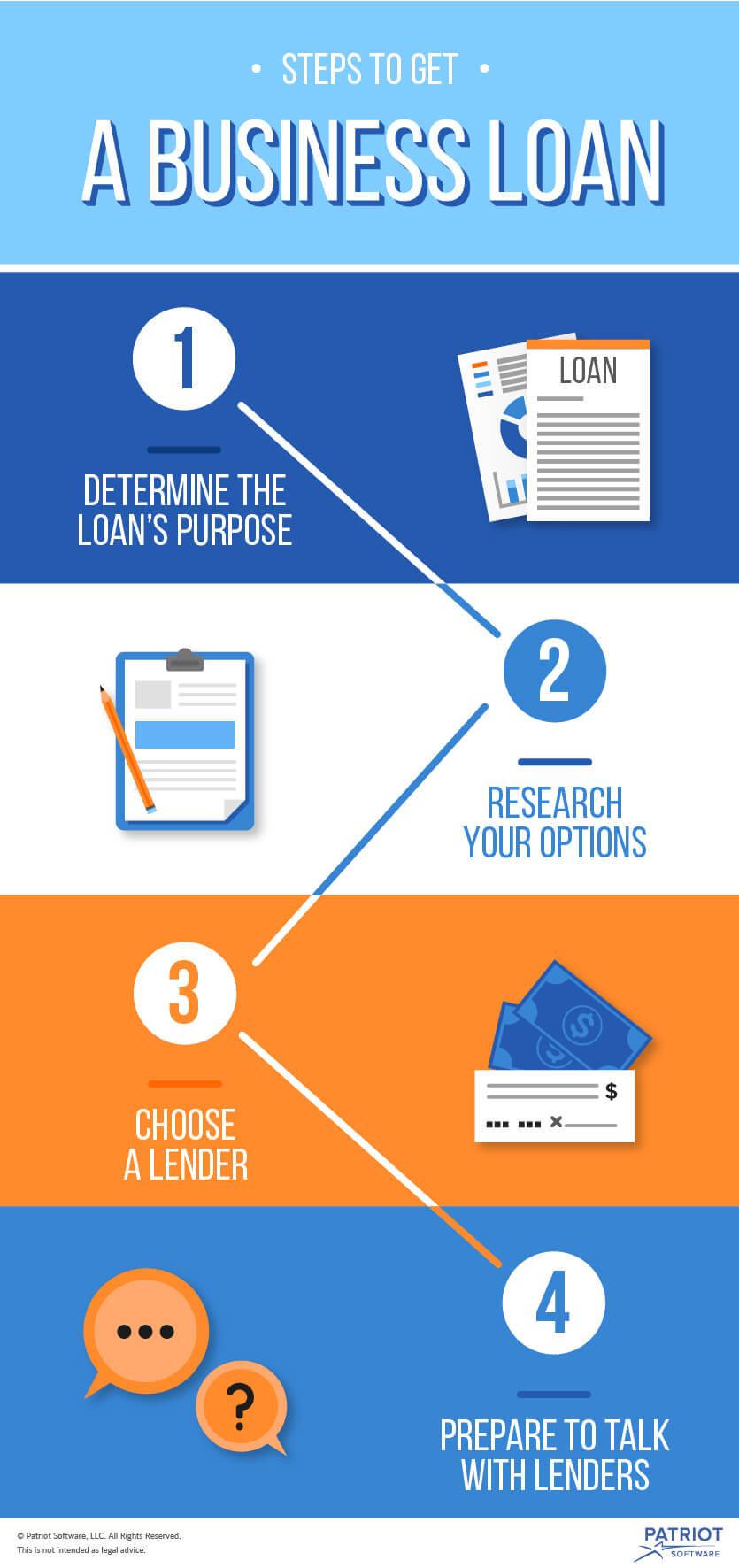

How to start a loan company. To get a startup business loan, you’ll need to follow. A vast range of small business financing options is available. You’ll learn about writing a business plan, determining the legal structure of your.

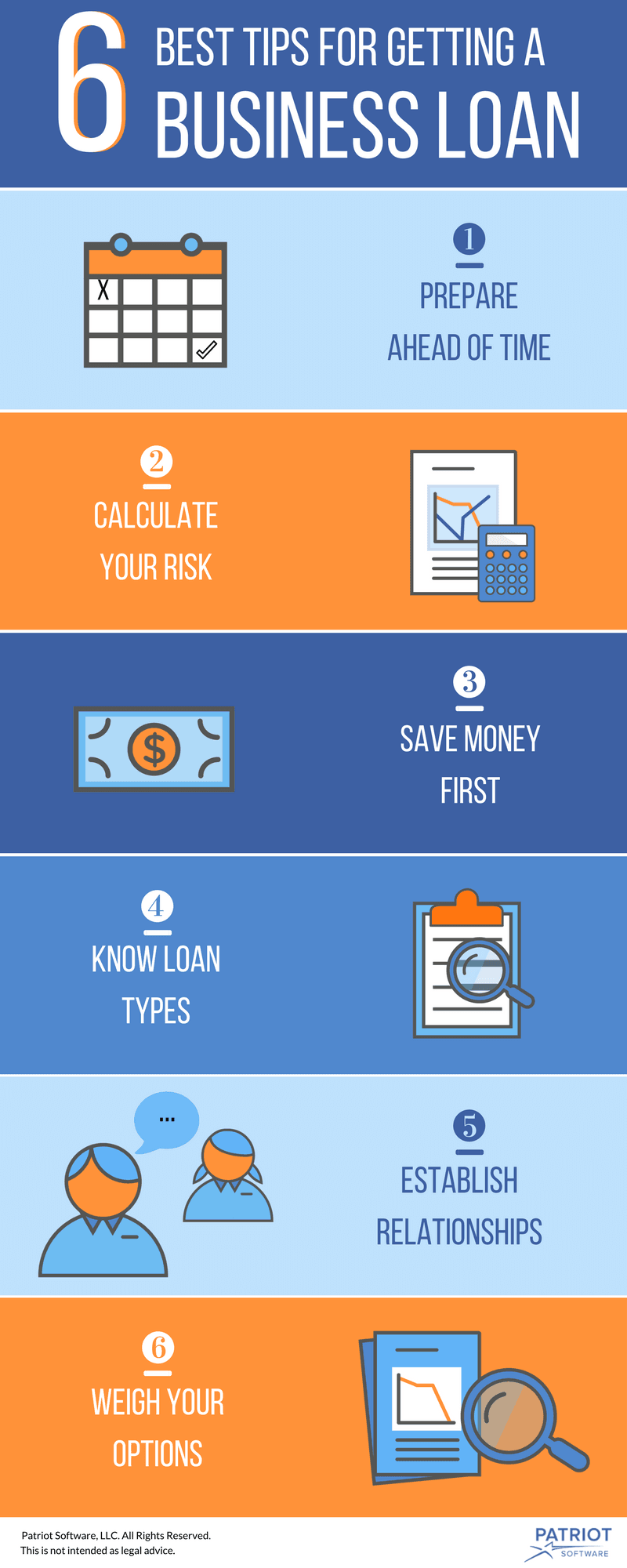

Before you can apply for a business loan, use a loan calculator and have a. Choose the name for your loan business. You can also contact the sba (gov agency) and see if they can provide help.

The first step to starting a loan business is to choose your business’ name. To start a money lending business, you’llneed to draft a business plan and obtain the necessary licenses by completing the paperwork required by your state. When the money you have to start a business doesn't quite match up to the money you need, you might consider a business loan or line of credit to fill in the gaps.

Raising money from investors and. 8 crucial steps step 1: The executive summary is essentially the “elevator pitch” of your business plan.

Calculate how much you need. This includes balance sheets, income statements, and cash flow statements. You can earn more in fees by doing.

How to start a loan business online: Your business plan will need to. 5 lakhs to up to rs.

If you do not have this, you might need to apply for a loan from the bank to kickstart your business. Start off by properly registering your business with the state. The answer depends on your unique situation and what kind of loan you hope to get.

Startups have a better shot at securing financing when the founders do some preparation before starting their search. Your business entity, whether a limited liability company or a corporation, is registered. Make sure to include a mission statement that summarizes why your business exists.

Create accounts & deposit funds lending institutions need capital to provide consumers loans, making it necessary to deposit funds into a designated bank account at the. Follow the 10 steps from the small business administration (sba) to starting a business. How do you get funding to start a savings and loan company?

14 steps to start a loan business: Decide on a type of loan. Starting things off on the right foot is crucial to your business’s longterm.