Beautiful Info About How To Reduce Interest Rate Risk

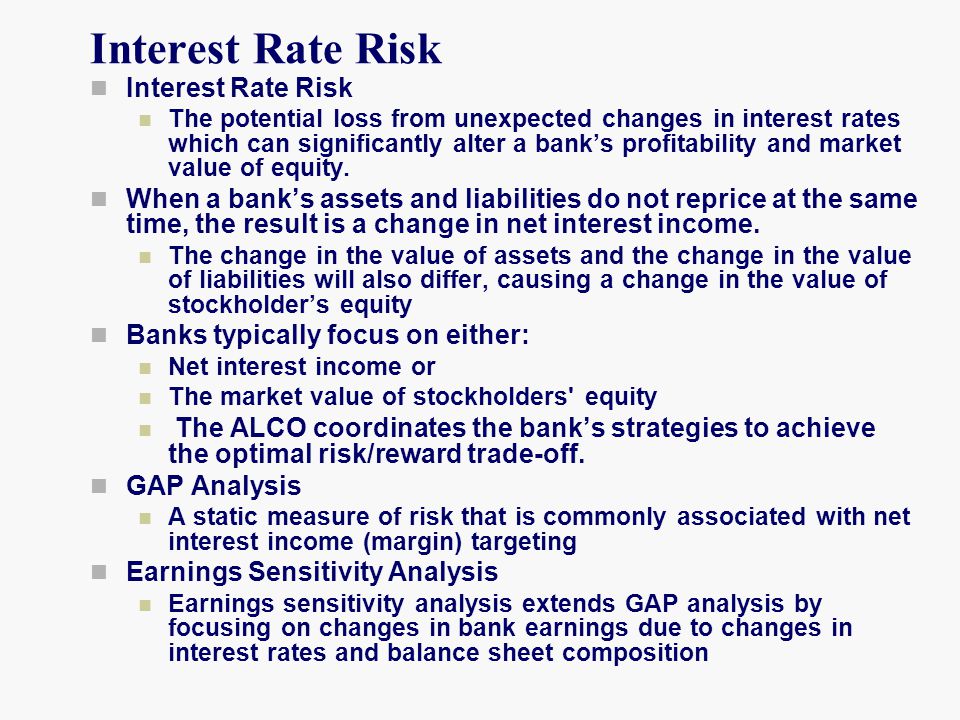

Choose a fixed rate loan.

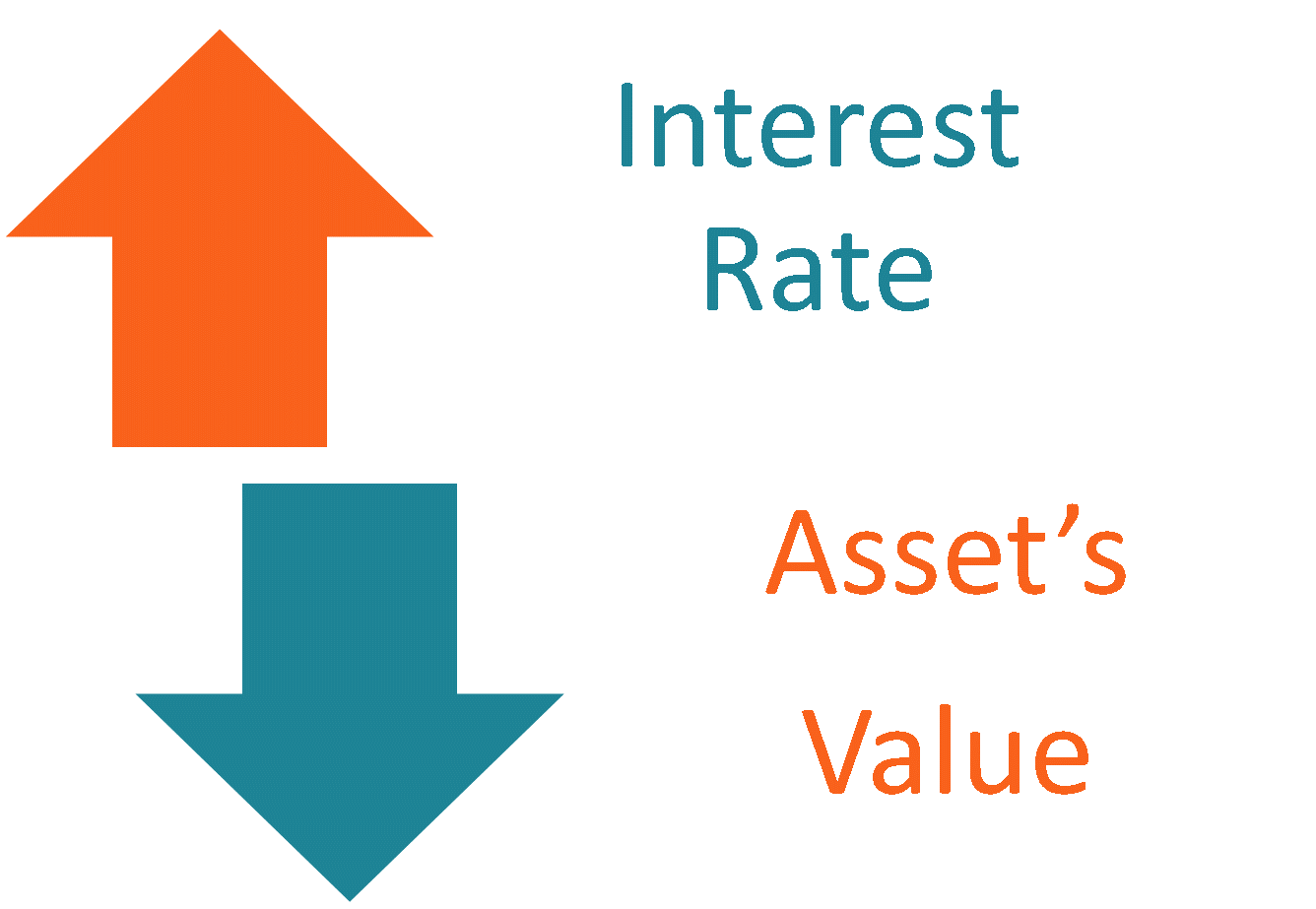

How to reduce interest rate risk. If interest rates fall, futures prices will rise, so buy futures contracts now (at the relatively low price) and sell later. Call risk similar to when a homeowner seeks to refinance a mortgage at a lower rate to save money when loan rates decline, a bond issuer often calls a bond when interest rates drop,. A variety of financial models are available and have become more sophisticated and accurate, allowing for bank determined assumptions and leading to a more effective assessment of.

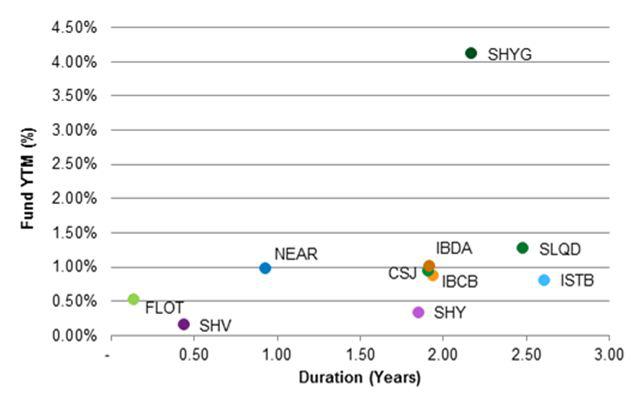

How to reduce interest rate risk: The safest option for investors who are trying to reduce the risks associated with interest rates is to invest in bonds and certificates, which have short maturity tenure. The difference between the rate of return on your.

As prices go down, yields go up):. Locking in one rate for the life of a loan can help you keep one factor steady should interest rates change before you’ve paid the loan back. Futures represent less risk than forwards because they are standardized and involve an intermediary.

The depositor fears that interest rates will fall as this will reduce income. Interest rate risks are often reduced by holding bonds at completely different times, and investors can also scale back rate of interest risk by combining fastened financial. Small businesses should think through how much interest rate risk they’re willing to take on and whether there are strategies they can incorporate to mitigate.

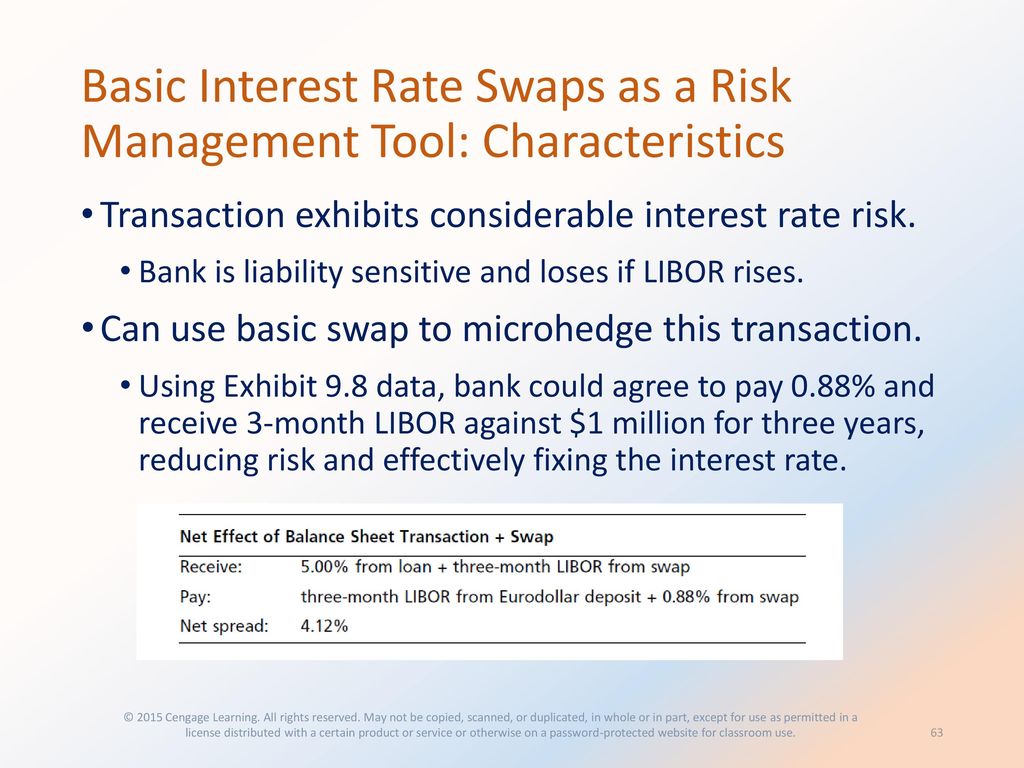

The most popular strategies for protecting against rising interest rates include (keeping in mind that as rates go up, bond prices go down; A hedging strategy may be useful to reduce the risk of a sizable interest rate gap. Smoothing smoothing is one of the simplest hedging methods.

/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)