Beautiful Work Info About How To Lower Your Credit Apr

Having a good apr for credit cards is important for a number of reasons.

How to lower your credit apr. It’s best to pay off your balance in full but if you don’t or can’t, a higher apr makes your debit grow faster. If the representative says they. Find a card with features you want.

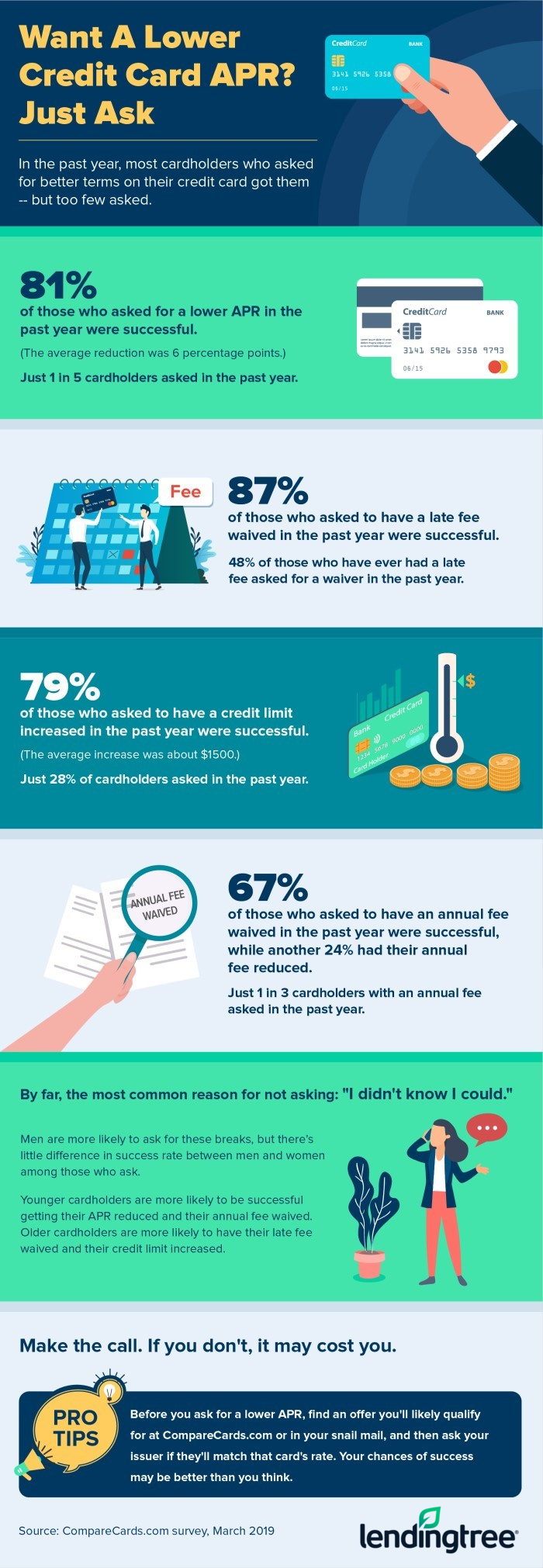

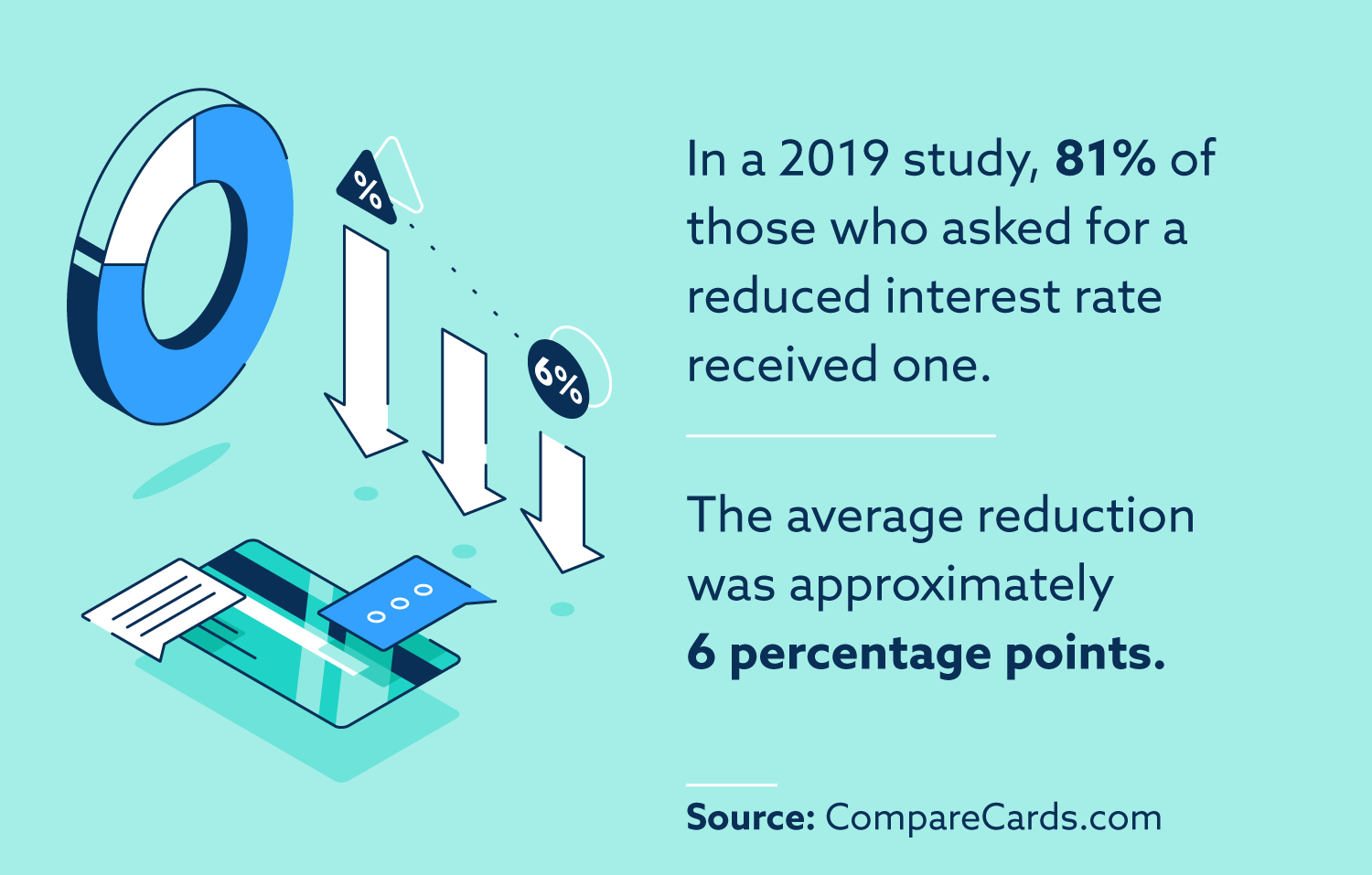

It doesn’t hurt to ask your credit card issuer to lower your interest rate. Your credit card company won't lower your apr just because you've been taking care of your credit; Ad responsible card use may help you build up fair or average credit.

You could start by pointing out your history with the company. Before you call the customer service number on the back of your credit card,. Ad one low monthly payment.

Find a card offer now. Persistence is key when negotiating a lower credit card apr. But online banks and credit unions are looking to attract more deposits to feed their thriving.

Balance transfer as an alternative to a lower rate for credit cardholders facing carried balances with high interest rates, a balance transfer card option may help reduce a rate. There are countless credit cards — all with different rewards options. Call the customer service line on the back of your card and start the conversation.

These four steps can help you secure a lower rate: See offers from verified better business bureau® accredited partners. In turn, this can make it easier and faster to pay off.

An improvement in your credit score is critical if you want to start reducing the apr. Take an inventory of your financial health and credit standing. How to lower your credit card interest rate 1.

If your card has a high annual fee, or the annual fee is eating up a big chunk of your rewards, it might be time to switch to a. How can i lower my credit card apr? Annual fees are undercutting your card benefits.

Tell the representative that you've received numerous offers for a much lower interest rate from other credit card companies, but that you don't want to have to move your. You need to call them and ask them to lower your apr! You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a.

Ad we've rated the best options for getting out of debt. Save 50% or more monthly. How to lower your credit card interest rate 1.