Top Notch Info About How To Get A Tin

Ad over 2 million businesses have trusted us to help them get started.

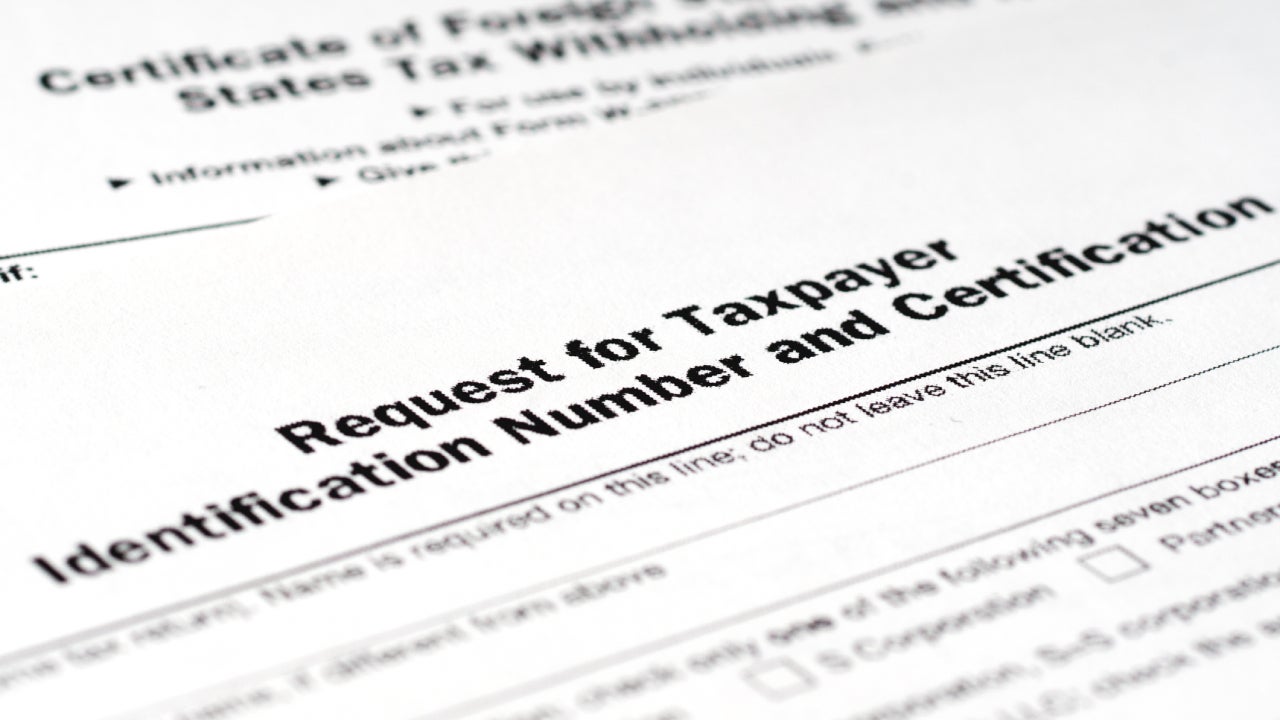

How to get a tin. Generally aliens may apply for either a social security number (ssn) or an individual taxpayer identification number (itin) for use on tax related. How to get an ein: You must include the payee's tin on forms, statements, and other tax documents.

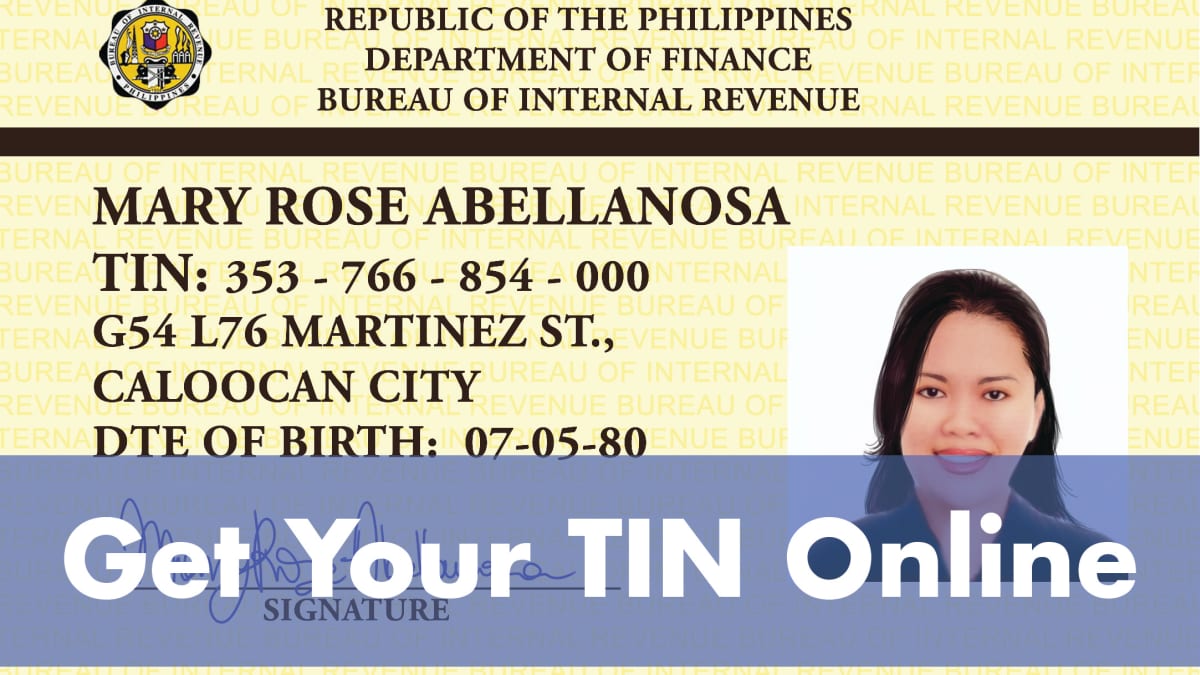

How to get a replacement tin id for lost or damaged card. Non individuals such as (limited liability companies, incorporated trustees, enterprises, cooperative society, mdas, trade. The requirements and procedure on how.

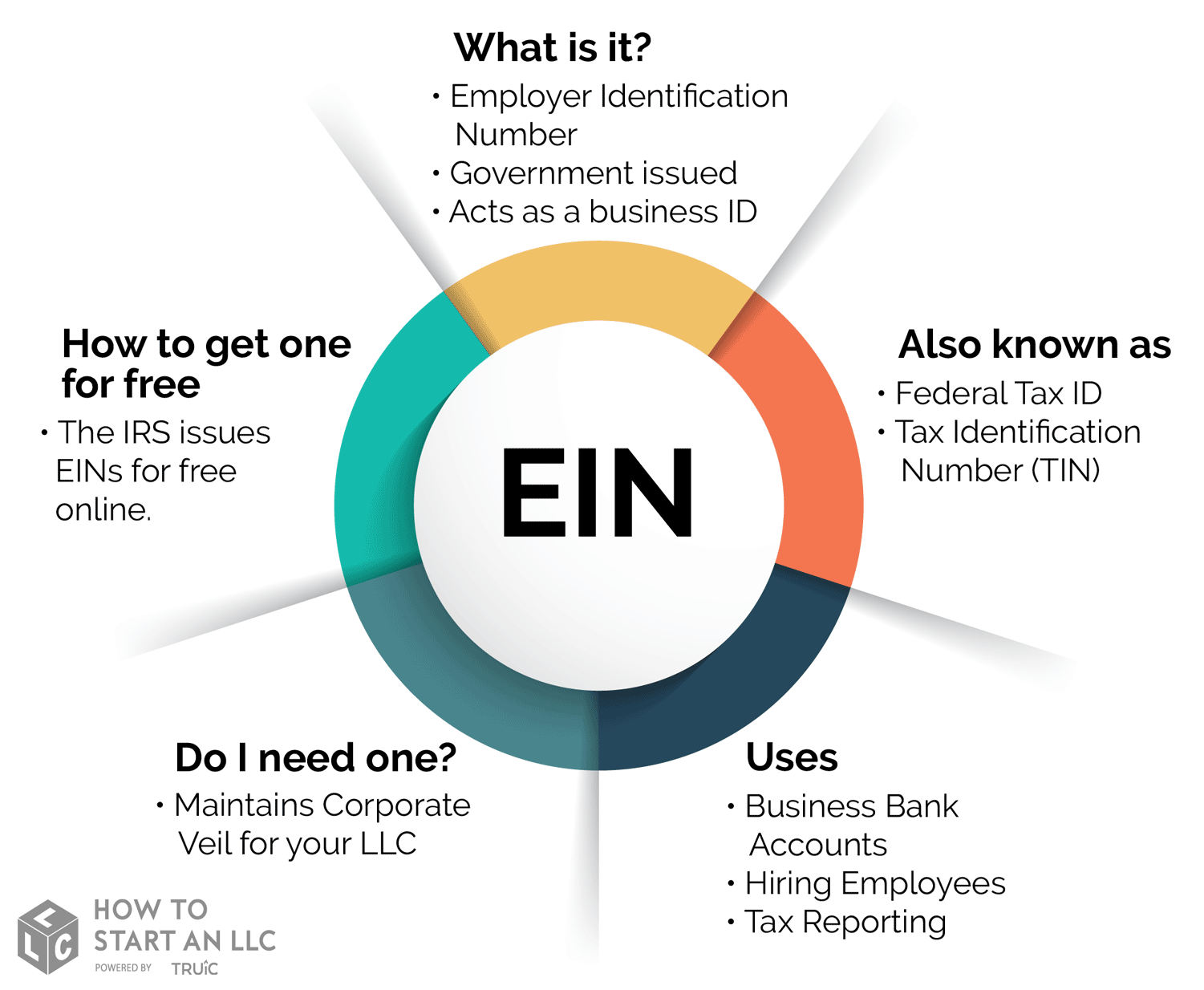

You can apply for this tax id number online with the irs. Your tin is most likely the business entity’s employer identification number (ein). In order to obtain your tin number in nigeria, you need to follow a process laid down by the joint tax board (jtb) in nigeria.

If seven weeks go by and you don’t receive a response, you can call the irs to check on the status of your itin application: Select tax identification number on the select search criteria dropdown list below; The irs may require an estate or trust to get an ein.

An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service. An individual may have a social security number. Wait for an email from the bir.

To get a tin as an individual, you need to have a nin or bvn. To register for tin as an. How to get tin number ✓

Tin state codes across india Download and print bir forms 1905 and 0605. Any identification issued by an authorized government body (e.g.

Birth certificate, passport, driver’s license, community tax certificate) that shows the name,. Where to get the application forms. The payee's tin may be any of the following.

A taxpayer identification number (tin) is a means of uniquely identifying taxpayers or potential taxpayers (i.e. Individuals can now apply for tin online using their bank verification number (bvn) to get a tin as an individual, you need to have a nin or bvn. Visit the bir ereg website.

The irs issues itins to individuals who are required to have a u.s. The joint tax board has an improved electronic system for. Individuals and corporate bodies) for.

/tax-indentification-number-tin.asp_final-7524207031a4442187c30846d85f1ee2.png)