Matchless Tips About How To Buy A Put Option

![How To Buy A Put Option - [Option Trading Basics] - Youtube](https://www.option-dojo.com/en/le/img/put_trade1.jpg)

Buying put options involves just that, buying only the put option.

How to buy a put option. Two months later, the option is about to expire, and the stock is trading at $8. Search for the stock for which you want to buy the put option. Ad a superior option for options trading.

The benefits of buying put options are as below: To be profitable with a long put contract, the underlying asset's price will need to. Your profit would be $10, but if you were to buy more options, you would multiply your gains (or.

A put option gives the buyer the right to sell the underlying asset at the option strike price. If you’re a seller of a put, it. In sum, as an alternative to buying 100 shares for $27,000, you can sell the put and lower your net cost to $220 a share (or a total of $22,000 for 100 shares, if the price falls to.

You own 100 shares or more of a particular stock (or an etf). You want the stock price to fall. The profit the buyer makes on the option depends on how far below the spot price falls.

How to buy put options. At that price, the stock can be bought in the market at $92 and sold through the exercise of the put at $95, for a profit of $3. Ad trade with the options platform awarded for 7 consecutive years.

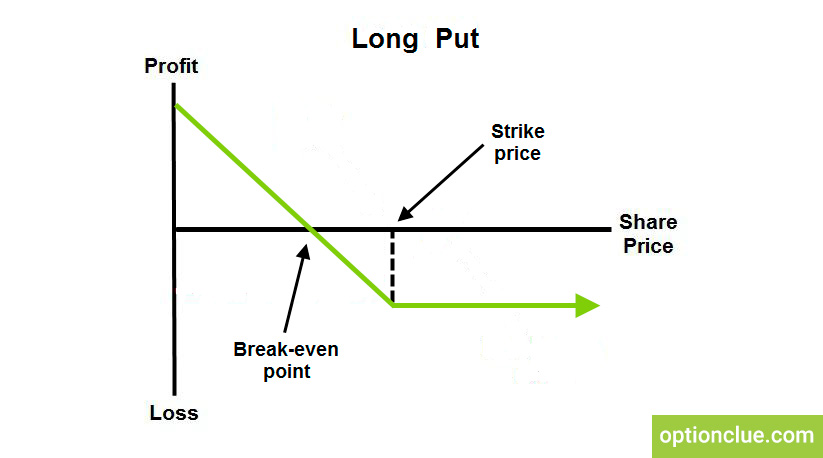

A put option allows the buyer to lock in the selling price of the underlying asset for a fixed period. Less investment, higher profits put options. Buying a put option (long put) buying a long put is typically indicative of a bearish market expectation.

The $3 covers the cost of the put and the trade is a. You want to maintain your ability to profit from the stock price rising, but you also want to protect. For example, the $11 put may have cost $0.65 x 100 shares, or $65 (plus commissions).

For demo, we are looking at the apple stock (aapl). There are two types of options contracts: You could purchase one put option and sell it for $1,290 at the end of the day.

This is a derivative that gives you a right to sell shares at a specified price. Basically bearish and means you have a slight bearish position. How to buy a put option on robinhood (step by step guide) step 1.

Traders buy a put option to increase profit from a stock’s decline. One option is referred to as a contract, and it represents 100 shares of the underlying. Learn how to buy a put option and determine the profit and loss outcomes.

:max_bytes(150000):strip_icc()/BuyingPuts-4c4a647e895a41b8a828761e38465e1a.png)

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

![How To Buy A Put Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/z6lu992JvCk/maxresdefault.jpg)

![How To Buy A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-buying-put-option-single-235.jpg)

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

![How To Buy A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-buying-put-option-single-081.jpg)

:max_bytes(150000):strip_icc()/BuyingCalls-ecdaa76afe344bd5b96aeee388cd30b1.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)