Favorite Tips About How To Avoid Company Car Tax

Below are the ways to avoid paying sales tax on a car:

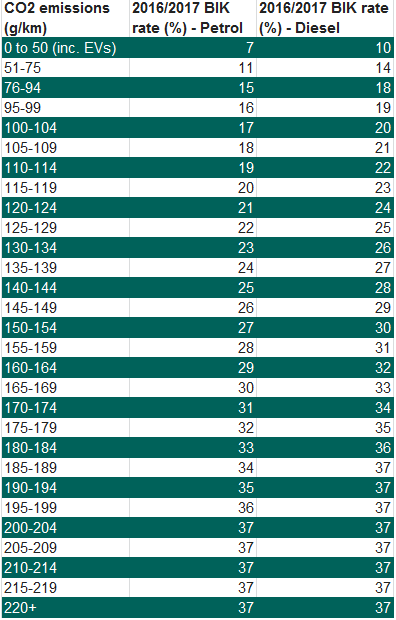

How to avoid company car tax. The benefit in kind tax rate, also known as the bik rate, is determined by a variety of factors, such as the driver's tax bracket, the car's co2 emissions and fuel consumption and. The two most important factors in calculating company car tax are the p11d. If you don`t want to compromise on the model, reducing the number of extra extras reduces the p11d value.

How can i reduce my company car tax? As mentioned, there are changes to company car tax which means from next year you will not be. The point about paying for private fuel is that eliminates the additional bik for having free fuel.

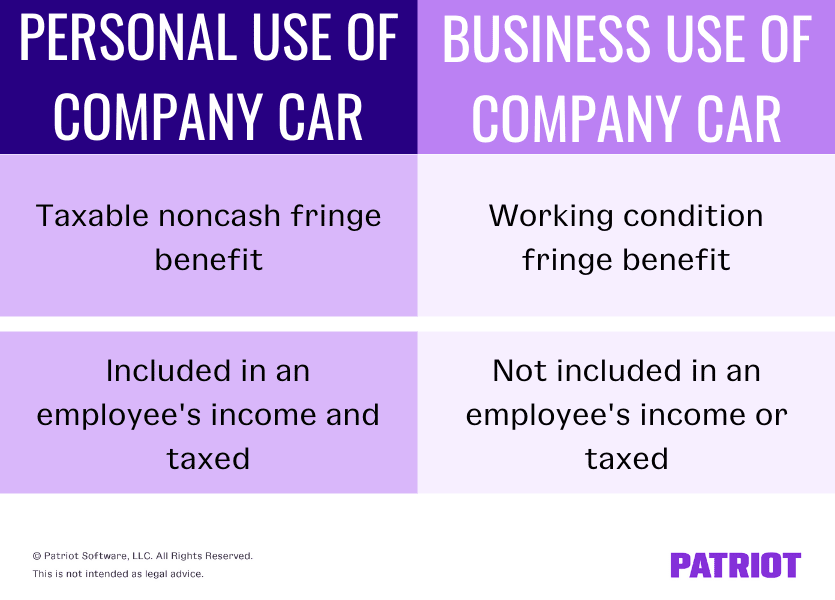

You can avoid paying sales tax on a used car by meeting the exemption circumstances, which include: Every month, each employee’s mileage is multiplied by the irs mileage rate. A company can avoid taxation of a car allowance by tracking the business mileage of its employees.

Private usage being prohibited is the only way to avoid a benefit in kind charge on a company car. How to avoid paying sales tax on a used car: Another way is to get a car with lower co2 emissions.

There are a number of ways to reduce your company car tax such as getting a car that has a lower p11d value. You will register the vehicle in a state with no sales tax because. It does not in anyway impact the bik for the car itself.

If you rely on a commute to work with public transportation and avoid using the company car on. Many companies have moved away from. Sometimes, you may pay more tax on the use of a company vehicle than on a travel allowance.

The easiest way to cut your company car tax bill is to choose an electric car. Pool cars are not deemed a bik so there is no tax. Another option to avoid unwanted imputed income for personal use of a company car would be for the employee to simply return the company car.

But if you seriously want to save on company car tax, then the. If your son does not. How do i avoid paying tax on a company car?

Add the vehicle in your tax filing; You can reduce the bik on a. Time is running out to take advantage of the 0% tax band for 2020/21, but with a.

If the vehicle is driven a total of 10,000 kilometers during the year, 4,000 kilometers is driven for personal use and 6,000 kilometers for business use with the total expenses for the vehicle is. You can also reduce the company car tax by considering the size, age, and frequency of use.